How Much Do I Have to Pay? The Real Costs of Buying a Home in Calgary

Buying a home in Calgary is an exciting step — but if you’re like most people I talk to, the big question usually comes down to one thing:

“How much do I actually need to have saved?”

Let’s break down what you really need to budget for, without the fluff, confusion, or fine print. I want you fully prepared and confident going into your purchase.

🔹 1. Down Payment — What You REALLY Need in Calgary

Here’s what most buyers don’t realize:

Your down payment depends entirely on the price of the home.

In Canada:

-

5% down payment → for homes up to $500,000

-

10% down payment → for the portion between $500,000 – $999,999

-

20% down payment → required for homes $1M+

-

20% down also removes mortgage insurance (often referred to as CMHC)

Example:

A $550,000 Calgary home requires:

-

5% of first $500,000 = $25,000

-

10% of remaining $50,000 = $5,000

Total minimum down payment = $30,000

Most buyers are surprised at how low the minimum actually is — but remember, the down payment isn’t the only cost.

🔹 2. Closing Costs — The Part Most Buyers Forget

Expect to budget 1.5% to 4% of the purchase price for closing day expenses.

Here’s what’s typically included in Calgary:

✔ Home Inspection

$400–$600+ depending on size/age of home

(Worth every penny — the right inspector can save you thousands.)

✔ Legal Fees (Lawyer + Title Work)

$2,200–$2,800 total

Includes paperwork, title transfer, disbursements, courier fees, etc.

✔ Property Tax Adjustments

If the seller prepaid taxes, you reimburse your portion.

Avg: $200–$1,500 depending on timing.

✔ Condo Document Review (if buying a condo)

$300–$500

Highly recommended — this protects you from special assessments and poor reserve funds.

✔ Home Insurance

Required before possession.

Roughly $60–$120/month depending on property.

✔ Appraisal (sometimes required by lenders)

$300–$450

The good news?

There is NO land-transfer tax in Alberta.

This alone can save you thousands compared to other provinces.

🔹 3. After-Move Costs to Keep in Mind

Many buyers skip these when budgeting:

-

Movers ($500–$2,500)

-

Window coverings (if not included)

-

Appliances (if not included)

-

Lock changes

-

Furnace cleaning

-

Utility hookups

Not “mandatory”… but real.

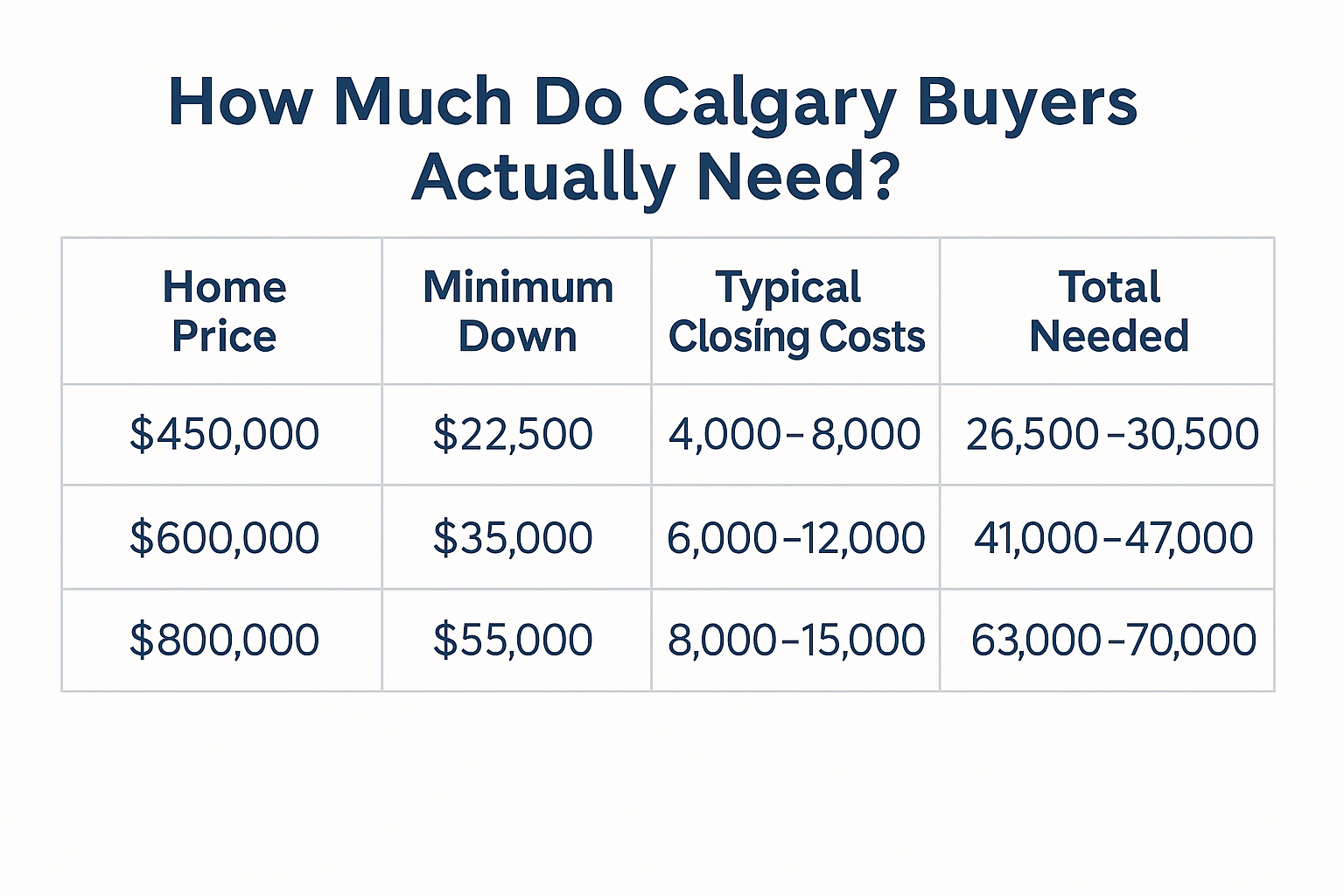

🔹 4. How Much Do Calgary Buyers Actually Need?

For most buyers I work with, here’s a realistic range:

(These are averages — I’ll run exact numbers with you.)

🔹 5. Want to Know EXACTLY What It’ll Cost You?

Every buyer situation is unique — income, savings, debt, approval, timing, and even the neighbourhood can all change the numbers.

If you want real, accurate numbers for your budget, I’ll run a free personalized cost breakdown.

No pressure. No obligation. Just clarity.

👉 Don't Pay Another Cent in Rent to Your Landlord Before You Read This

👉 Or shoot me a message — I’m always here to help.

Categories

Recent Posts